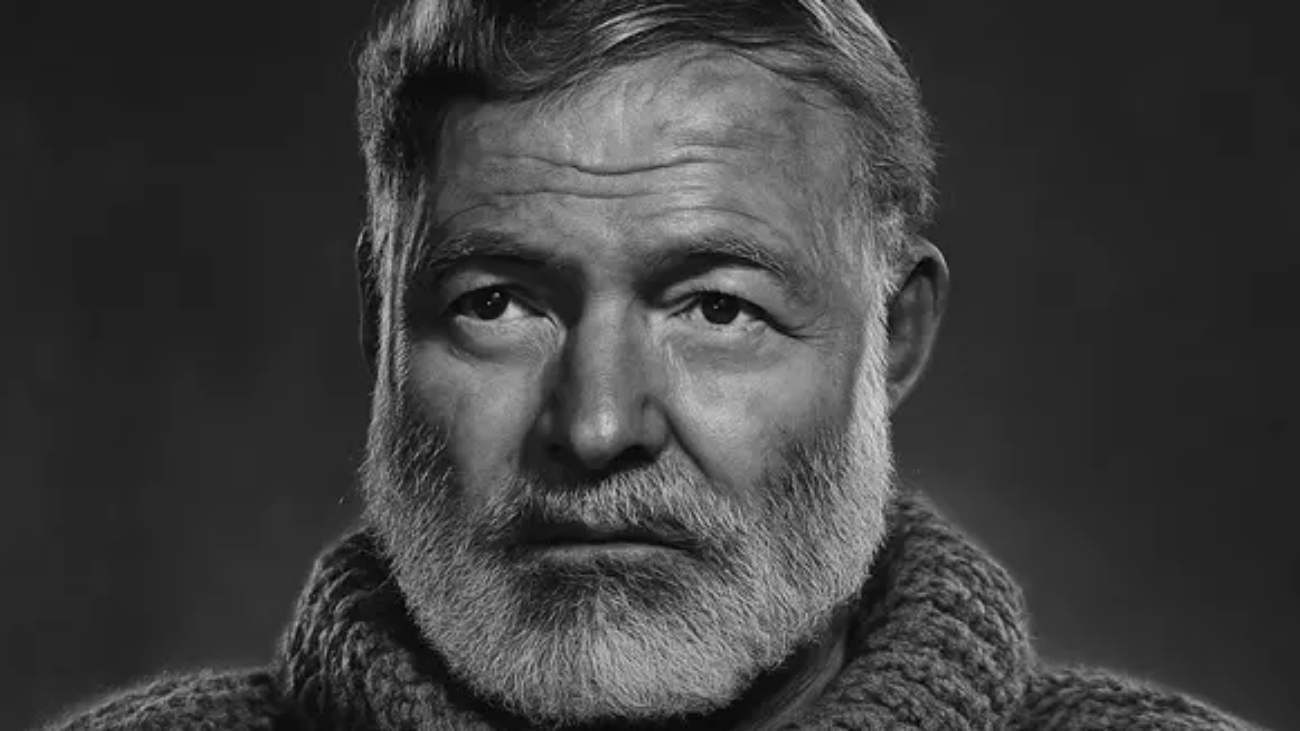

Ernest Hemingway once wrote, “Courage is grace under pressure.” While he was speaking of human character, the words resonate powerfully in today’s investment climate — especially in the world of high-end hospitality, luxury real estate, aviation, and curated experiences.

Luxury markets are shaped not only by capital flows and economic cycles but also by taste, trust, and reputation. They demand a level of composure and vision that goes beyond traditional investment models. Investors in this space face intense scrutiny, discerning clientele, and the pressure of maintaining both exclusivity and consistency in every move.

In other words, pressure is built into the segment. The differentiator is grace.

Grace in the Luxury Market

At BluWater and BluWater Venture Capital, we’ve seen firsthand that composure is often what separates the projects that flourish from those that falter. Grace in this context isn’t passivity — it’s discipline.

It’s taking the time to understand that a resort property isn’t just square footage; it’s a lifestyle promise. That a membership platform isn’t just technology; it’s a gateway into identity and belonging. That a marina or private aviation investment isn’t about assets on a balance sheet but about the seamless, curated experiences those assets deliver.

Grace means building for the long-term, even when short-term pressures tempt quick fixes. It means staying steady when markets wobble, because the true luxury client values consistency above all.

Courage in Decision-Making

Courage in the luxury sector doesn’t mean betting wildly. It means committing to bold visions with clarity and conviction.

It means investing in destinations and experiences that may take years to fully mature — but that, when done well, stand the test of decades. It means standing behind founders, operators, and partners who embody authenticity, because in the luxury world, inauthenticity is exposed quickly. And it means keeping your word with stakeholders, clients, and investors, even when the path forward is difficult.

Courage is the willingness to make thoughtful decisions under pressure, knowing that reputation is the currency of luxury — and it must never be compromised.

Why This Matters Now

The current investment climate is defined by constant change. Geopolitical currents shift. Consumer expectations evolve. Technology redefines how people interact with brands. And luxury clients — perhaps more than any other audience — expect discretion, personalization, and unwavering quality through it all.

Yet in this environment, luxury markets are increasingly being recognized as a stable and secure direction for the future.While mass-market segments may fluctuate with economic uncertainty, luxury continues to demonstrate resilience. The strength of discerning demand, coupled with limited supply and the enduring appeal of exclusivity, keeps the sector steady even when other markets waver.

That environment creates pressure. But pressure is not the enemy. The true differentiator is how we respond.

At BluWater, our conviction is simple: grace under pressure is not just a Hemingway ideal — it is the cornerstone of leadership in luxury investment.

The BluWater Mindset

• We stay composed in volatility. Luxury markets reward steadiness, not panic.

• We invest in people, not just properties. A jet, a yacht, or a villa means little without the operators and hosts who create lasting experiences.

• We lead with reputation. In the luxury space, trust is the ultimate ROI.

• We see luxury as stability. As markets evolve, luxury remains a secure, future-focused direction for growth.

Closing Thought

Hemingway’s line reminds us that the true test of leadership isn’t when things are easy, but when the pressure is highest. In luxury, where trust, taste, and timing are everything, courage and grace are not optional — they are the foundation.

At BluWater, we carry that philosophy into every investment and every relationship. Because in this space, courage is not about taking risks for the sake of it. It’s about leading with discipline, steadiness, and trust — even when the spotlight is bright and the stakes are high.